1. Likuiditas

a. Current Ratio

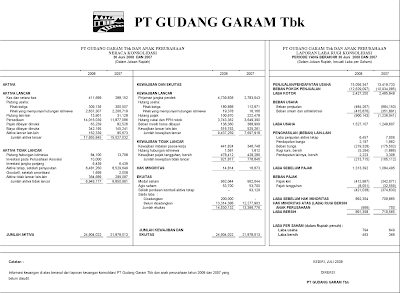

Current Ratio = (aktiva lancar / hutang lancar) * 100%

Current Ratio = (Rp. 17.955.845 / Rp. 9.437.259) *100%

= 190,26%

b. Cash Ratio

Cash Ratio = ((kas + surat berharga) / hutang lancar) * 100%

Cash Ratio = ((Rp. 411.689) / Rp. 9.437.259) * 100%

= 4,362%

c. Quick Ratio

Quick Ratio = ((aktiva lancar - persediaan) / hutang lancar) * 100%

Quick Ratio = ((Rp. 17.955.845) / Rp. 9.437.259) * 100%

= 190,26%

2. Solvabilitas

a. Total Assets to Total Debt Ratio

Total Assets to Total Debt Ratio = ( total hutang / total aktiva ) * 100%

Total Assets to Total Debt Ratio = ( Rp. 10.359.076 / Rp. 24.904.022 ) * 100%

= 41,60%

b. Net Worth to Total Debt Ratio

Net Worth to Total Debt Ratio = ( modal sendiri / total hutang ) * 100%

Net Worth to Total Debt Ratio = ( Rp. 962.044 / Rp. 10.359.076 ) * 100%

= 9,28%

3. Rentabilitas

a. Gross Profit Margin

Gross Profit Margin = (laba kotor / penjualan netto) * 100%

Gross Profit Margin = (Rp. 2.427.250 / Rp. 15.056.347) * 100%

= 16.12%

b. Operating Ratio

Operating Ratio = ((HPP + biaya adm) / penjualan netto) * 100%

Operating Ratio = ((Rp. 6.457 + Rp. 415.876) / Rp. 15.056.347) * 100%

= 2.80%

c. Net Profit Margin

Net Profit Margin = (laba setelah pajak / penjualan netto) * 100%

Net Profit Margin = (Rp. 892.354 / Rp. 15.056.347) * 100%

= 5.92%

Tidak ada komentar:

Posting Komentar